Steve Randy Waldman makes a case for eliminating the tax incentive for corporate and individuals to borrow. I think it is a fair argument but I would not eliminate it but reduce it to a point where the

marginal cost of bankruptcy is greater than the marginal benefit to borrow. Of course determining the point of inflection is hard as it is difficult to gauge the ability to quantify the above cost-benefit structure by managers of

businesses. Here is a excerpt from his post, which I thought outlined the theory of his argument:

According to canonical financial theory a firm's debt/equity split, or "capital structure", should have no effect on overall firm value. It's just different ways of slicing up the same money pie, in a common metaphor. But if you introduce tax deductions for debt payments, the equation changes. Then the theory predicts that a rational firm should load up on debt financing, in order to capture the benefit of the "interest tax shelter". If bankruptcy were not an issue, rational firms would move to ~100% debt financing in order to extract the largest possible subsidy. With bankruptcy a possibility, a rational firm loads up on debt until the marginal increase in bankruptcy risk outweighs the marginal benefit of the subsidy. But if imperfect managers underestimate bankruptcy risk during periods of stability, they may unwittingly (or purposefully, if there are agency problems) bring firms close to the brink, provoking traumatic failures when the gales of an untamed business cycle blow strong and hard. By covering a large fraction of corporate interest payments, the government effectively subsidizes financial risk-taking that serves no operational purpose but generates real social costs.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ad42751c-a35b-48d3-8479-f9f89cea1032)

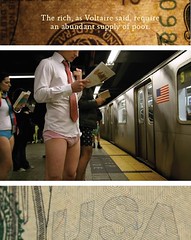

Image by Renegade98 via Flickr

Image by Renegade98 via Flickr![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ad42751c-a35b-48d3-8479-f9f89cea1032)

No comments:

Post a Comment