Image via Wikipedia

Image via Wikipedia

He made an argument that an investor wanting to invest in a VC funds would not choose the above allocation. I asked him to ellaborate and he said that the investor will not get the total bang for his buck... he said that if the above fund´s VC allocation returned say 100% of the allocated capital the investor would only get 15% of that 100%. Sounds logical but this is precisely the problem with our view of the world and our ability to calculate probabilities. We think about only the success scenario, we don´t think about failure and the proabilities of failure.

Lets do a thought experiment of comparing two funds:

1. A fund that invests all the capital into VC companies

2. A fund that does capital allocation similar to the one described in the first paragraph

We need to think of alternative universe of outcomes to calculate the expected return from the above two funds, lets conjure one for simplicity:

VC companies return 100% of capital invested with a probability of 50% and return -100% (i.e you loose all the capital) with a probability of 50%. Growth companies return the capital invested and Cash returns the same at the end of the investment time for simplicity sake.

Given the above outcome what is the Expected return for the above two funds, say for an investment of $100m?

Expected Return = P(success) x Return + P(failure) x Return

Fund 1: 50% x $200 + 50% x (-$100) = $50m

Fund 2: 50% x $30+ 50% x (-$15) + $5 + $80 = $92.5m

Even the above simple payoff matrix gives the second fund a return higher than the all VC fund. However the real world is much more complex and the payoffs and probabilities are much harder to calculate. In addition to the above when we do capital allocation there are time frames, return expectations and conditional probabilities involved, this further skew the results.

The above payoff matrix gives us different results when we add conditions to the problem:

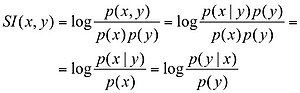

What is the probability of Fund 1 giving a lower return than Fund 2 given VC companies all return 100%? or we can flip the question

What is the probability of Fund 2 giving a higher return than Fund 1 given VC companies all return 100%?

The above question needs us to calculate the probability of a VC company being a success or a failure and the distribution for VC success follows a Power Law. I think most VC fund managers understand that but I don't have data to prove it. My fear is that maybe fund managers do not compute probabilities using the Power Law but the Normal Gaussian Bell Curve, when we do that all the above analysis and results are incorrect.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=cb0bcf8d-f1c3-4bfe-8ce7-ba469d2b767c)

No comments:

Post a Comment