[Original Post Written @http://startupiceland.wordpress.com]

[Original Post Written @http://startupiceland.wordpress.com]I have written about Crowd Funding and how I want to throw my weight behind this. I think this is an important topic in the blog sphere and many lawyers are weighing in on the challenges. Here are a couple:

- Crowd Funding – A Critique for Entrepreneurs and Investors by Bill Payne, Angel Investor

- The Great Crowdfunding Train Wreck of 2013 by Antone Johnson, Business Lawyer

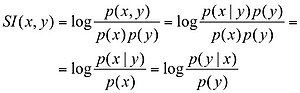

- Radical Information Asymmetry

- Valuing Early Stage Companies and evaluating the Risk-Reward can be done only by Experts

- Cost of Transparency and Accountability is too high for small early stage companies

I will go into the details of each one of the below.

- Radical Information Asymmetry: The Securities and Exchanges Commission (SEC) in the US or in any other country basically have a number of requirements that protect the small investor, i.e defining all the Risk factors, ensuring that companies wanting to raise money from the public are not fraudsters (the perception is that but there have been exceptions and I have always wondered how do they ensure that?) etc. The most important of all these requirements is that the Founders/Company Managers have more information about the company than the general public so they could potentially "hide" the detrimental information from the investor thereby "cheating" money away from the investor. On a theoretical level I agree with this information asymmetry, but practically I don't think this is a problem because companies in their early stage don't have any complications in their accounting or operational procedures, so it should be simple enough to basically share all the information that the company has and most early stage companies usually do.

- Valuing Early Stage companies is hard and measuring Risk-Reward ratio is best left to experts and experienced professionals. I could not disagree more with this assessment. Valuing companies in their early stage is very hard and I have written about it. That is the reason why private placement of securities i.e shares in a company require the investors to be accredited investors, the definition of who an accredited investor is weird, according to the federal securities laws define the term accredited investor in Rule 501 of Regulation D as:

- a bank, insurance company, registered investment company, business development company, or small business investment company;

- an employee benefit plan, within the meaning of the Employee Retirement Income Security Act, if a bank, insurance company, or registered investment adviser makes the investment decisions, or if the plan has total assets in excess of $5 million;

- a charitable organization, corporation, or partnership with assets exceeding $5 million;

- a director, executive officer, or general partner of the company selling the securities;

- a business in which all the equity owners are accredited investors;

- a natural person who has individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person;

- a natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year; or

- a trust with assets in excess of $5 million, not formed to acquire the securities offered, whose purchases a sophisticated person makes.

So basically if you are not rich or work for a Financial Institution you cannot be an investor! what a bunch of baloney! It really makes me mad they actually put Banks and Financial Institutions above Individual Investors. I have worked in a Bank and I know many of the people who make the investment decisions, I think an Entrepreneur would be more careful and weigh the options better than what I have seen done. So I don't buy this argument. I also think there is too much emphasis given to "protecting" the small investor, I am not so sure that is such a problem. I also do not believe a person working in a financial institution has better understanding of Risk than a person who has nothing to do with finance. I am big fan of Nassim Taleb and Daniel Kahneman. Go and read their books if you really want to understand how we as humans just don't have a good grasp of probability which in Financial jargon is Risk.

- Cost of Transparency and Accountability for smaller companies will be prohibitively high that would prevent them from actually going through the exercise of full disclosure.

Related articles

- Developments in Crowd-funding (growthology.org)

- Crowdfunding and the ninety nine percent (sciencetoprofitsblog.com)

- Crowd financing in return for start-up equity? (thesuitblawg.wordpress.com)

- Should Equity-Based Crowd Funding Be Legal? (online.wsj.com)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=cb0bcf8d-f1c3-4bfe-8ce7-ba469d2b767c)